SCROLL

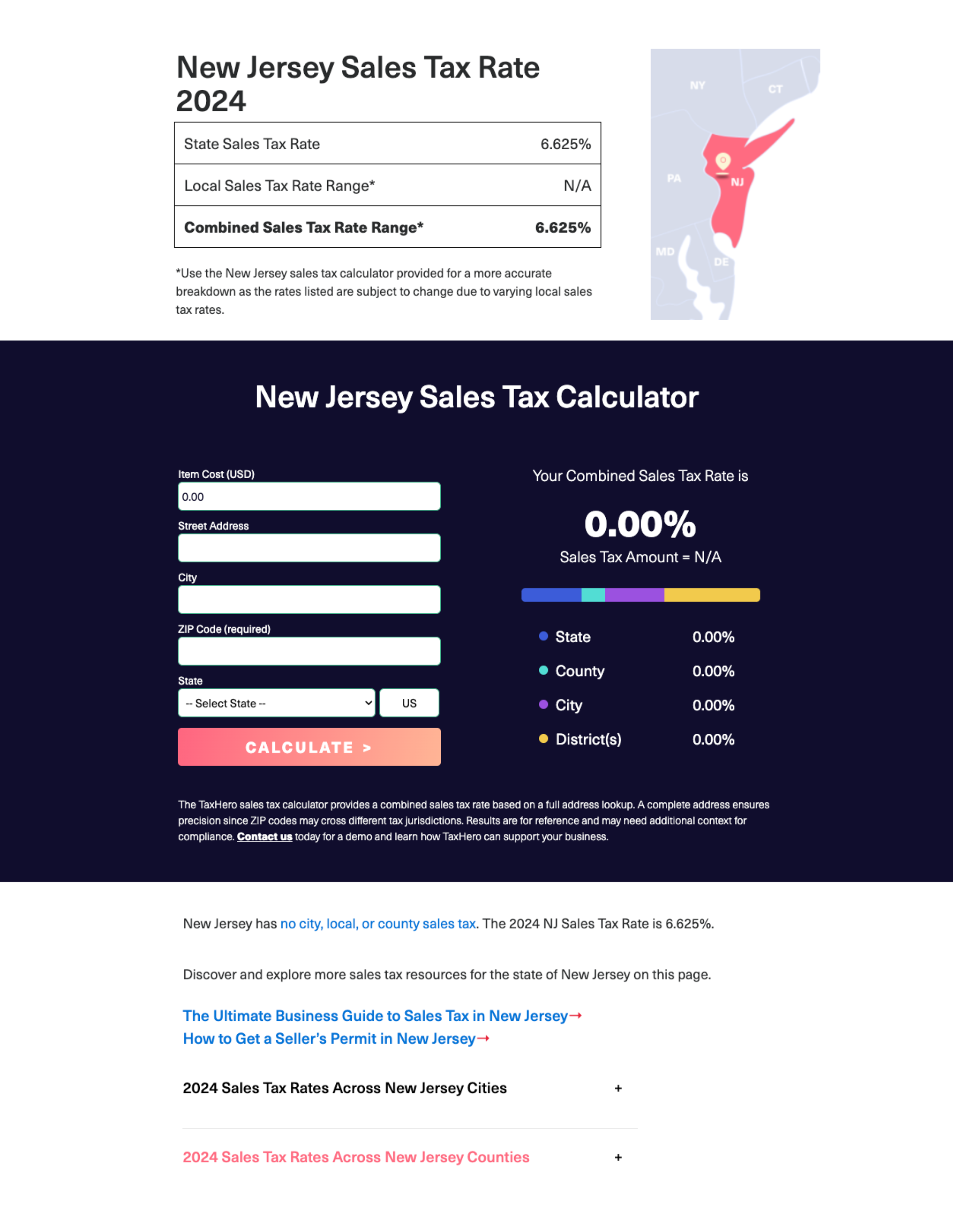

One of their core professional services has been in sales tax computation, payment, and filing of sales tax returns for clients across the USA.

To leverage technology to scale their client base and address complexities involved in sales tax management of e-commerce clients, Tax Hero wanted a digital solution.

Manual sales tax computation, payment, and filing of returns particularly for e-commerce clients were getting to become inefficient and uneconomical. With the advent and proliferation of e-commerce businesses, it became more complex, and they wanted a digital solution that could extract sales transaction data from e-commerce platforms, initially of the merchants on Shopify, to handle varying sales tax computation and filing depending on the state in the USA where each delivery was made.

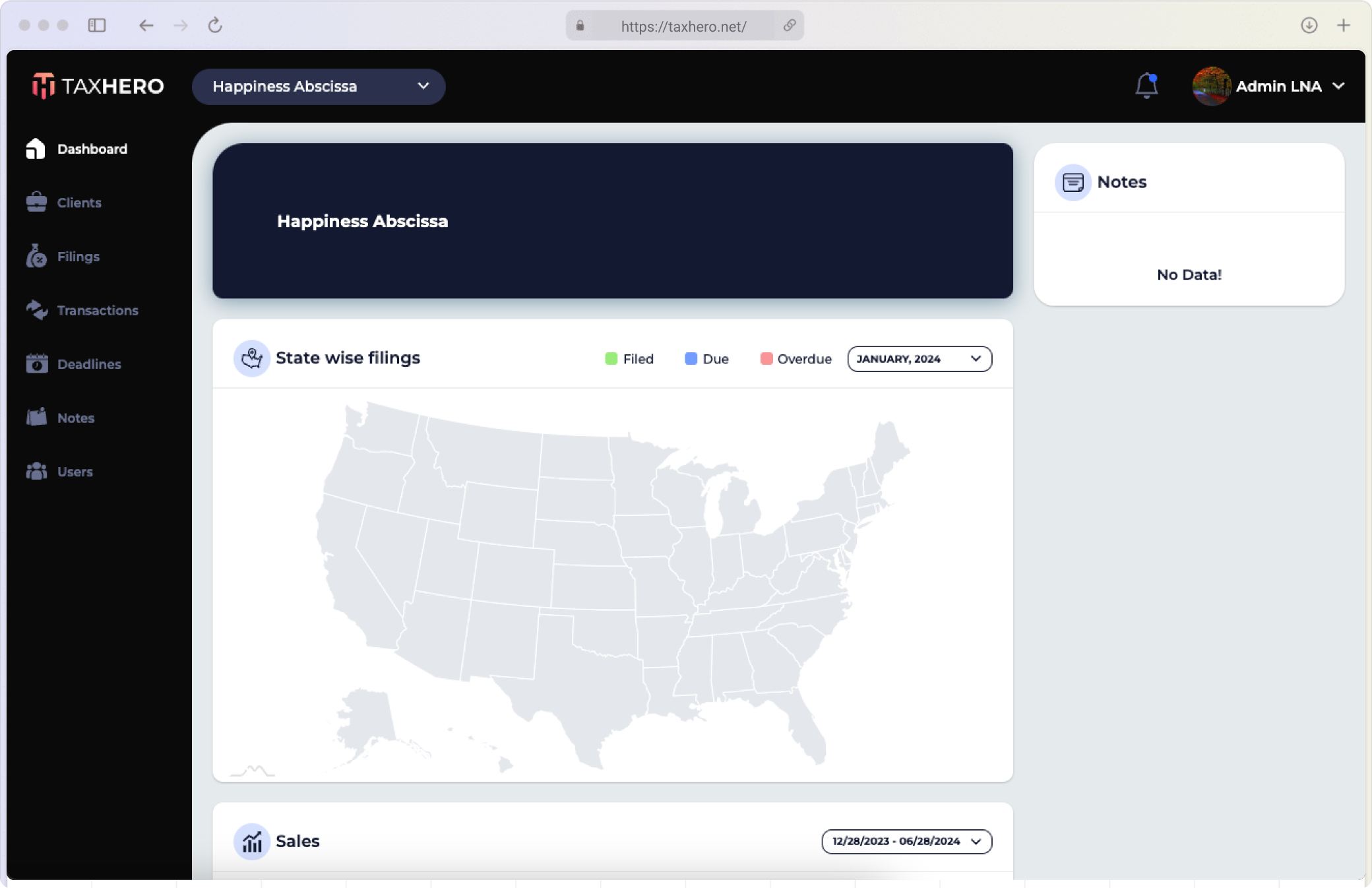

All these processes are now done with the solutions in a few minutes which used to take hours and even days with the manual process. Another challenge it solves is the need for dynamic changes in algorithms based on dynamic changes in tax rules and rates in each state.

Innvectra studied the Sales Tax system in each state in the USA, and what pain areas Tax Hero wanted to solve, before designing and developing the solution. Our ultimate objective was to keep its technology and platform updated with the evolving technological advancements so that the company could scale its professional services business without changing the system which would need substantial investment.

The solution was conceived to drive Tax Hero to scale horizontally by making the application suitable for use on other e-commerce platforms like Shopify.

The Tax Hero application is designed to automate the following processes that were done manually or using spreadsheets, etc.:

It allows the firm’s team to perform faster sales tax processing that helps them add and serve more clients with the same resource strength

It enables the firms to reduce operating costs and enhance the bottom line of their professional services business

Never miss the dates for tax payments and filing the returns

The productivity of the application helps the CPA firms and Tax consultants improve their top line and bottom line and, in the process, enables them to deliver services to the clients at a rate cheaper than previously.